For both the landlord and the tenant, dealing with damages can often be a dreaded affair, as it represents both a long and costly procedure. The Parsian real estate agency, Lodgis, and the insurance broker, French Furnished Insurance, are both specialists in the furnished rental sector, offering theoretical advice and practical guidance based on frequent cases.

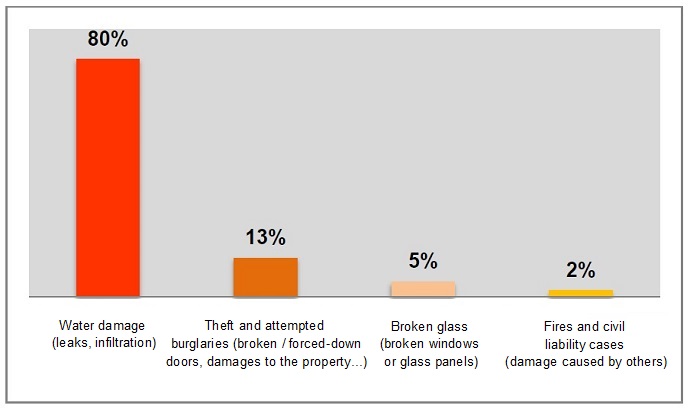

* Ratios by French Furnished Insurance

To determine which insurance policy (the tenant's, the landlord's or the buildings) should cover the cost of the damages, there are three key factors to address:

What is the cause of the damages?

For example, in the case of water damage, is it the hot water tank, a faulty seal or even an exterior infiltration?

The tenant is responsible for the routine maintenance of a property (cf. Act n°87-712, 26th August 1987), whilst the landlord is responsible for general works and repairs. As for joint ownership, collective owners must maintain the building and communal areas. The cause of the damages thus allows you to establish whose insurance shold be liable to cover the costs.

Who are the victims?

If the damages relate to the décor, the furniture or one's personal belongings, the tenant represents the aggrieved because during the rental he or she is in charge of the furniture.

When the damages affect parts of a property itself (a door, for example), it is the landlord who is affected.

If the communal parts of a building are damaged, the collective owners are the principal victims.

Identifying the cause of damages and the injured person(s) enables you to establish which insurer(s) should be claimed from.

Dealing with damages to a furnished rental differs in a number of ways from with an unfurnished property. It is, therefore, vital for both the tenant and landlord of a furnished property to be familiar with current regulations to make sure thay they are fully insured and to avoid potential disputes.

For furnished rentals, insurance is only a requirement when the property serves as the tenant's primary resience. In other cases, this is often an obligation that must be agreed on in the contract. In terms of damages, the tenant's responsibility will usually be assumed. If he or she is not covered by insurance, then they must pay for the damages caused, which can amount to very significant costs.

The ''convention CIDRE'' is an agreemnt signed by the insurers, which is designed to simply and speed up the compensation process in cases of water damage. But this does not apply to furnished rental tenants, who fall under the jurisdiction of common law. This exception must therefore be taken into account when such a form of damage occurs, also for the sake of accelerating the compensation process.

Non-occupant owner (PNO) insurance, now obligatory under the loi ALUR, allows property owners to cover their civil liability. The lessor can take out an additional policy so as to be covered in case the tenant or collective owners have insufficient insurance cover.

To deal with damages, you will need to follow a specific set of technical rules and procedures.

In cases of water damage, the perpetrator and victim(s) of the leak must declare the damages to their respective insurance providers, then complete and return a specific form. The leak must be repaired as soon as possible, otherwise a claim cannot be made.

For a theft or vandalism, a report must be filed with the Police and the original statement (Procès Verbal) must be posted to the insurance company, by recommended letter with acknowledgement of receipt (Accusé de Réception). The policy holder must add a statement of the damages to these documents on a seperate sheet of paper, which gives details of the dates, circumstances and specific losses (in the form of a list that catalogues the stolen items). Receipts for the said objects must also be provided so that an expert can give an estimate for the damages.

For certain damages in which several insurers are involved, the expert appraisals are made in a ''contradictory manner'', that is to say that all parties concerned (tenant, landlord, property management company, insurers) are summoned after 21 days. This mandatory window gives any other parties the time, meanwhile, to contest the assessments made.

Compensation is generally paid in two installments: an immediate payment following the return of the expert appraisal, then a deferred payment once the receipt of repairs or goods replaced has been received.

The speed with which a damages claim can be resolved depends largely on the participation of each of the parties. The quality of the insurance policy is, of course, also a factor. But in a shared residential building, claims on an insurance policy cannot be finalised without the collective agreement of all parties to actively manage the case. This is why it is important to seek assistance from rental management and insurance professionals.

Damages: damages to the property's original décor (paintwork, surfacing).

Useful tips: the tenant will need to report the water damage to his or her insurer and the neighbour above must do the same.

Who pays what? In most cases, the landlord will be covered by the insurance for the joint ownership or by his/her own insurance as a non-occupant owner, unless the tenant is insured on the property under a specific contract.

Damages: damages to the property itself (front door forced open).

Useful tips: Be careful when choosing a locksmith as this is a way in which people are frequently overcharged, especially if the the incident occurs at night.

Who pays what? When there are physical damages to the property itself, the tenant's insurance will cover up to 1600 euros (excluding tax) after an expert appraisal, provided that a theft policy has been taken out. In excess of this, the collective insurance provider for the building is responsible for providing compensation.

Damages: Damage to the property, furniture and equipment, the destruction of the tenant's personal belongings.

Useful tips: The scale of damage makes it important to prioritise and collectively deal with the different steps to receiving compensation (decontamination, appraisal and refurbishment), requiring the participation of a number of different professionals as well as the parties involved (tenant, neighbours, landlord and estate agent).

Who pays what? The tenant's insurance covers all of the costs, which is why it's important for the landlord to check that the tenant is properly insured.

Damages: Damage to the property, furniture and personal belongings of the tenant.

Useful tips: In this situation, an act classifying the incident as a natural disaster is normally published, enabling insurers to compensate their victims via a public financial fund set up for this purpose.

Who pays what? The insurers of the tenant, collective owners and/or non-occupant owner cover the damages before being reimbursed from this public fund once the act has been officially passed.

Read more:

Are you the owner of a furnished rental property? Benefit from Lodgis' exptertise as a specialist in furnished rentals and rental management... starting at 3.9% including taxes!

Do you want to list your property on our website? Post your listing right now, it is FREE and NON-EXCLUSIVE!

List your propertyDo you want to learn more about our rental offers and management starting at 3.9% including taxes? Our expert agents are at your disposal!

Contact us +33 1 70 39 11 07OXYGEN Agency

Emmanuelle Catheline & Aude Jasaron

T :+33 6 79 06 36 11

@ : send an mail